Introduction: Why Tech Is Your Best Ally in Retail’s Early Days

Starting a retail business today isn’t just about having the right products or a great location. It’s about mastering the digital tools that can turn your small operation into a smart, agile business. Yet, many new retailers feel overwhelmed by the sheer number of apps, platforms, and software options out there — wondering which are essential and which are just noise.

If you’re just launching or validating your retail idea, you might be thinking: “Do I really need all this tech? Can I afford it? How do I even begin to choose?” These questions are valid and show you care deeply about making your business succeed without wasting time or money.

The truth is, technology is not an expense—it’s an investment. When chosen wisely, the right digital tools can simplify tasks, improve customer experience, save money, and help you compete with bigger players. They empower you to work smarter, not harder.

This article will guide you through 10 indispensable digital tools designed specifically for new retailers. These tools cover everything from managing inventory and sales to marketing and customer engagement, all while being affordable and easy to use. Whether you have a physical store, an online shop, or both, these apps will help you launch smarter and grow faster.

Most importantly, these tools were selected to help you avoid common tech pitfalls, minimize risk, and free you up to focus on what really matters: your customers and your products.

Launching a retail business can be a steep learning curve — but with the right tech toolkit, you don’t have to do it alone. Let’s equip you with the tools to succeed from day one.

1. The Foundation: Choosing the Right Point of Sale (POS) System

One of the very first tech decisions you’ll make as a new retailer is choosing your Point of Sale (POS) system. This tool is the heart of your retail operation — it handles sales, processes payments, tracks inventory, and often manages customer data. Picking the right POS can save you countless headaches and streamline your daily workflow.

What to look for in a POS system?

A good POS for new retailers should be:

- User-friendly: You and your staff should be able to learn and operate it quickly without long training sessions.

- Affordable: Many POS systems offer free trials or low-cost starter plans. Avoid committing to expensive contracts before you test what fits your business.

- Inventory management: It should track your stock in real-time to avoid overselling or running out unexpectedly.

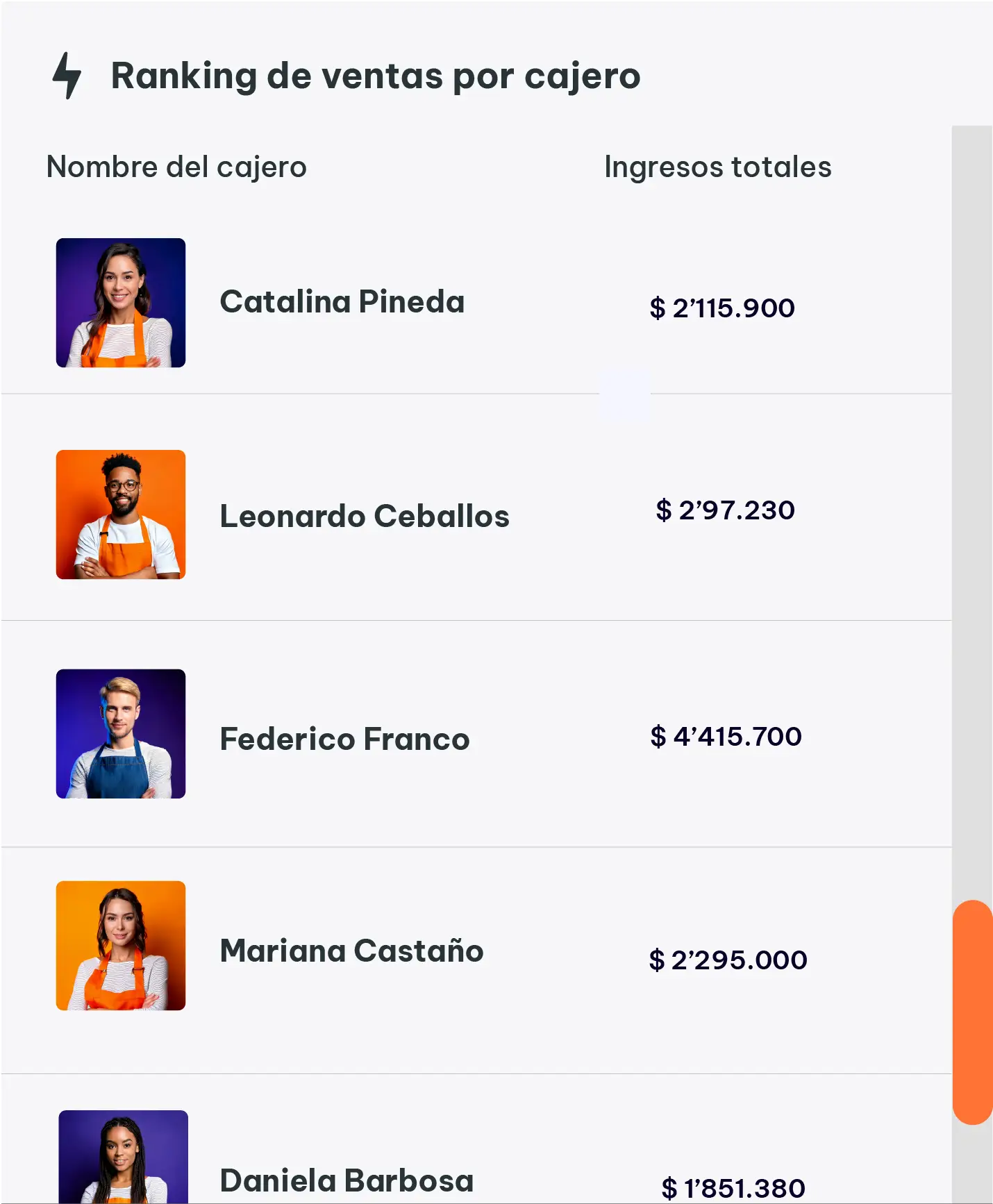

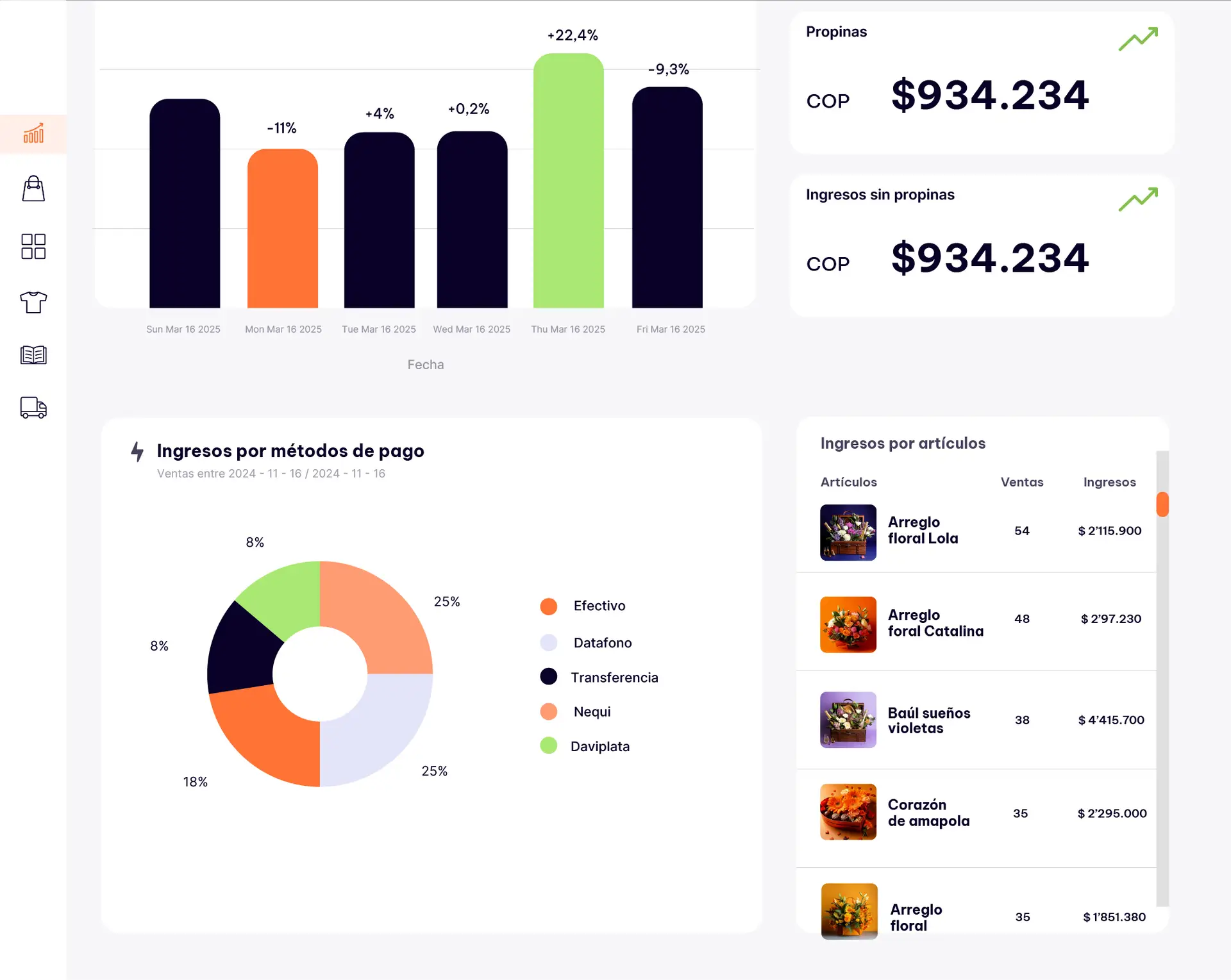

- Sales reporting: The system must give you clear, understandable reports that help you make better business decisions.

- Integration capabilities: The best POS systems connect easily with other tools you’ll use later — like accounting software, e-commerce platforms, or marketing apps.

Examples of popular POS systems for new retailers:

- Square: Very popular for its ease of use, free basic plan, and ability to work on tablets or phones.

- Shopify POS: Great if you plan to sell both online and offline.

- Vend: Good for inventory-heavy stores, with robust reporting features.

Why it matters:

A strong POS system helps you keep track of every sale and inventory movement automatically, reducing manual errors and freeing up your time. This accuracy is key to controlling costs and understanding your customers’ buying habits.

Practical tip:

Before you invest, try free versions or demos of at least two POS systems. Test them during your typical sales scenarios. How fast is the checkout? Is inventory updating instantly? Is the reporting easy to read?

Practical Exercise:

Make a list of your must-have features in a POS. Then research at least three options online. Sign up for their free trials and simulate a day’s sales. Note which system feels most intuitive and meets your budget and needs.

2. Building Your Online Presence: Essential Website and E-Commerce Tools

In today’s retail landscape, whether you operate a physical store, an online shop, or both, establishing a strong digital presence is a cornerstone of success. Customers increasingly research, compare, and buy products online — and your business must be visible, trustworthy, and easy to engage with in the digital world.

Why invest in a website and e-commerce tools?

A website is more than a digital business card; it is your 24/7 storefront accessible to anyone with internet. Without it, you miss countless opportunities to connect with new customers, build your brand, and generate sales. Even a simple, well-organized site can make a powerful first impression and set you apart from competitors.

Choosing the right platform:

Begin by selecting a website builder or e-commerce platform that fits your needs and budget. Shopify is highly popular among retailers for its ease of use and built-in e-commerce features. Wix and Squarespace offer drag-and-drop interfaces and beautiful design templates, ideal for those who want creative control without technical headaches. For those with WordPress experience, WooCommerce offers powerful customization for online stores.

Key features to prioritize:

- Ease of use: You should be able to update content and add products without needing a developer.

- Mobile-friendly design: Since over half of online traffic comes from mobile devices, your site must be responsive and visually appealing on phones and tablets.

- Secure payment options: Ensure your platform supports multiple payment gateways (credit cards, PayPal, etc.) with SSL certificates to protect your customers’ data.

- SEO fundamentals: Adding metadata, keywords, alt text on images, and fast loading times are essential to rank higher on search engines and attract organic traffic.

- Social media integration: Connect your online store with your social accounts to increase reach, enable sharing, and run coordinated campaigns.

Practical benefits for your retail business:

A strong online presence allows you to showcase your products with clear photos, descriptions, and reviews, making it easier for customers to decide and buy. It also opens the door to online marketing strategies such as email campaigns, Google Ads, and social media promotions — all driving more foot traffic or orders.

Practical Exercise:

Choose one website builder and create a trial store. Focus on uploading your top 3 products with good images and descriptions. Set up basic payment options and test the mobile version of your site. Share your website with trusted friends or potential customers for feedback on usability and appeal.

3. Inventory Management: How to Stock Smart and Avoid Cash Flow Problems

One of the biggest challenges new retailers face is managing inventory wisely. Buying too much can drain your cash quickly, while buying too little means missing sales and disappointing customers. Striking the right balance is critical for your startup’s survival and growth.

Why does inventory management matter so much?

Inventory represents a major investment for any retail business. It ties up your money, occupies space, and requires monitoring. Poor inventory decisions can lead to overstocking, where unsold products take up capital and storage, or understocking, causing lost sales and unhappy customers.

Start small, test, and learn

When launching, focus on a limited product range. Choose your best-selling items or those with high margins to maximize the return on your investment. Start with smaller quantities to reduce risk, and track which products move faster. This approach lets you adapt quickly based on real customer demand without overextending your budget.

Use simple inventory tools

You don’t need expensive software to start. Many free or low-cost apps help track stock levels, sales, and reorder points. For example, tools like Square for Retail, Zoho Inventory, or even spreadsheets can keep your inventory organized and alert you when it’s time to restock.

Establish clear processes

Create a routine for receiving, counting, and organizing stock. Accurate records prevent errors and losses, and help you make informed purchasing decisions. Use labeling and storage systems that allow you to quickly find and manage products, saving time and reducing mistakes.

Keep an eye on cash flow

Inventory purchases affect your cash flow directly. Avoid tying up all your funds in stock by staggering orders and negotiating favorable payment terms with suppliers. Regularly review your sales trends and inventory turnover to optimize purchasing and maintain liquidity.

Practical Exercise:

Make a list of your initial product lineup. Estimate how many units of each you realistically expect to sell in the first 3 months. Research and select an inventory tracking method (app or spreadsheet). Set up a simple reorder alert system to avoid stockouts or overstocking.

4. Marketing on a Shoestring Budget: Getting Customers Without Breaking the Bank

One of the biggest hurdles for new retailers is attracting customers while keeping expenses low. Marketing can feel overwhelming or expensive, especially when budgets are tight. But smart marketing doesn’t have to mean costly ads or fancy campaigns — it’s about creativity, consistency, and knowing your audience.

Understanding your ideal customer

Before spending a dollar on promotion, get crystal clear on who your customers are. What problems do they have? What solutions are they looking for? What channels do they use to discover products? This clarity will help you focus your efforts and avoid wasting resources.

Start with organic and low-cost tactics

Social media platforms like Instagram, Facebook, TikTok, and Pinterest are gold mines for small retailers. They allow you to build community, showcase products, and engage customers directly at minimal cost. Start by creating authentic content: stories behind your products, how-tos, customer testimonials, or live Q&A sessions. Use hashtags and local groups to increase visibility.

Leverage email marketing early

Collect emails from day one, whether in-store or online. Email marketing has one of the highest returns on investment (ROI) and is a direct way to communicate offers, new arrivals, or events. Tools like Mailchimp or Sendinblue offer free tiers that are perfect for small retailers.

Partnerships and collaborations

Connect with complementary local businesses or influencers who share your target market. Co-host events, cross-promote on social media, or create bundle deals. These partnerships expand reach without large ad budgets.

Track and adjust

Set simple metrics to track your marketing results—followers gained, website visits, email signups, or sales linked to promotions. Use this data to refine your strategy and focus on what works best.

Example:

A new bookstore owner started by sharing daily posts about book recommendations and behind-the-scenes inventory picks. She joined local Facebook groups and offered exclusive discounts to email subscribers. Collaborating with a nearby coffee shop, they hosted a “book & brew” event that brought in new customers for both. All these efforts required minimal spend but built loyal customers.

Practical Exercise:

Identify your ideal customer profile and list three social media platforms they use. Plan a week’s worth of organic posts focused on storytelling and engagement. Set up an email collection method and draft a welcome email. Reach out to one local business for a collaboration opportunity.

5. Managing Your Finances Wisely: Tools and Tips to Stay in Control

Starting a retail business is exciting—but managing money wisely from day one is what keeps it alive. Many new entrepreneurs get overwhelmed by the complexity of finances or underestimate how much discipline it takes to track every dollar. The truth is, good financial management is not just for accountants—it’s a vital skill you can develop.

Create a simple but thorough budget

Start by listing all your expected expenses: rent, inventory, marketing, licenses, equipment, and even your personal draw if you’re paying yourself. Be realistic and leave a margin for unexpected costs. On the income side, project conservative sales estimates. This budget will be your roadmap and reality check.

Separate business and personal finances

Open a dedicated business bank account and, if possible, get a business credit card. Mixing personal and business money complicates taxes and hides the true financial health of your venture.

Use easy financial tools

Accounting software like QuickBooks, Wave, or even Excel templates can help you track income, expenses, and cash flow without needing a finance degree. Many offer free or low-cost plans suitable for startups.

Track cash flow closely

Cash flow—the money moving in and out—is king. You can have great sales but still run out of cash if bills and salaries aren’t timed right. Monitor your cash flow weekly or biweekly, and adjust spending accordingly.

Plan for taxes and compliance

Set aside a percentage of your income for taxes, and know your local rules regarding licenses and permits. This avoids surprises and penalties later.

Learn from your numbers

Regularly review financial reports to understand trends. Are sales growing? Which products have the best margin? Where can you cut costs? Use this insight to make informed decisions and adjust your strategy.

Example:

A new boutique owner used free accounting software to track all transactions. She separated her personal and business accounts and reviewed cash flow every two weeks. When noticing tight cash flow, she delayed some marketing spend and negotiated extended payment terms with suppliers, avoiding a cash crunch and keeping operations smooth.

Practical Exercise:

Create a simple budget listing your expected expenses and projected sales for the next 3 months. Open a separate bank account if you don’t have one. Choose one financial tool and input your transactions for the past week or simulate them. Set up a schedule to review your cash flow regularly.

Final Reflection: Taking the Leap Even When You’re Not 100% Ready

Starting a retail business is a journey filled with uncertainties, fears, and countless decisions. It’s normal to feel unsure, to question if you have enough money, the right location, the perfect product, or the ideal team. But the truth is, no one ever feels completely ready. Waiting for the “perfect moment” or the “ideal conditions” often means waiting forever.

The most successful retailers don’t wait—they start. They embrace imperfection, learn on the go, and adapt quickly. Every setback is a lesson. Every small sale builds momentum. Every conversation with a customer sharpens the business.

Remember, starting isn’t about having all the answers. It’s about courage: the courage to put your idea out there, to make mistakes, and to keep moving forward. The tools, technology, and financial tips shared in this guide are not just practical steps—they are your support system to help you build that courage.

Your dream of owning a retail business is valid. Your passion matters. Don’t let fear or doubt stop you from taking the first step. Whether you open a tiny pop-up shop, start online, or sell from your kitchen table, what counts is starting.

Take control of your finances, choose your tools wisely, and keep your vision clear. Most importantly, take action today. Because the only way to turn your dream into reality is to launch.

Your journey begins now.