Introduction: The Power of Monthly Reflection in Retail

Picture this: You’re three months into your retail journey, and while sales are happening, you can’t shake the feeling that you’re flying blind. You know customers are buying, but you don’t know why certain products fly off the shelves while others collect dust. You sense patterns in your business, but they remain frustratingly unclear, like trying to solve a puzzle with half the pieces missing.

This scenario is more common than you might think. Many retail entrepreneurs get so caught up in the daily grind of serving customers, managing inventory, and putting out fires that they forget to step back and truly understand what their business is telling them. They’re running a marathon without knowing their pace, direction, or how much distance they’ve covered.

The monthly business review isn’t just another administrative task to add to your growing to-do list—it’s your business’s health checkup, strategy session, and growth catalyst all rolled into one. It’s the difference between hoping your business succeeds and actively steering it toward success. When you commit to regular monthly reviews, you transform from a reactive business owner who responds to problems after they occur into a proactive leader who anticipates challenges and capitalizes on opportunities.

Think of successful retail chains like Target or local thriving boutiques in your neighborhood. What separates them from businesses that struggle or fail isn’t just luck or better products—it’s their commitment to understanding their numbers, recognizing patterns, and making data-driven decisions. They know which products generate the highest margins, which customer segments drive the most revenue, and which marketing efforts deliver the best return on investment.

The monthly business review is your opportunity to ask the hard questions: Are we moving in the right direction? What’s working exceptionally well that we should double down on? What’s not working that we need to fix or abandon? Which assumptions about our business have proven correct, and which need to be challenged?

This process isn’t about perfection—it’s about progress. Even if you’re just starting out with limited data, the habit of monthly reflection will compound over time, giving you increasingly valuable insights that inform better decisions. Your first monthly review might feel basic, but by month six, you’ll have a treasure trove of insights that most of your competitors lack.

1. Setting Up Your Monthly Review Framework: Building the Foundation for Success

Creating an effective monthly business review starts with establishing a systematic framework that you can follow consistently, month after month. Think of this framework as the skeleton of your review process—it provides structure and ensures you don’t miss critical areas that could impact your business’s performance.

The foundation begins with timing and preparation. Choose a specific date each month for your review, ideally within the first week after the month ends when data is fresh and complete. This isn’t a task you can rush through during a busy afternoon between customers. Block out 3-4 hours of uninterrupted time, preferably when your store is closed or during your least busy period. Treat this appointment with yourself as sacred—it’s as important as any meeting with your biggest customer.

Your review space matters more than you might realize. Create a dedicated workspace free from distractions where you can spread out documents, use your computer, and think clearly. Some successful retailers even conduct their reviews away from their store to avoid the temptation of multitasking. The goal is to shift from operational mode to strategic thinking mode.

Gather your essential tools and documents before you begin. This includes your point-of-sale system reports, accounting software data, inventory management system outputs, marketing campaign results, and any customer feedback collected during the month. If you’re still tracking some metrics manually, organize those documents as well. Having everything at your fingertips prevents the review from becoming fragmented or incomplete.

Create standardized templates or checklists that you’ll use each month. This consistency allows you to spot trends more easily and ensures you don’t accidentally skip important areas. Your template should include sections for sales analysis, inventory review, customer insights, financial performance, marketing effectiveness, and operational challenges. Many successful retailers create a simple one-page dashboard that captures the most critical metrics at a glance.

Establish your key performance indicators (KPIs) in advance. These might include total sales, average transaction value, customer acquisition numbers, inventory turnover rates, gross profit margins, and customer retention percentages. Having predetermined KPIs prevents you from getting lost in data that might be interesting but not actionable.

Practical Exercise: Create your monthly review calendar for the next six months. Choose a consistent date (like the 5th of each month) and block out 4 hours in your schedule. Set up a physical or digital folder where you’ll collect all necessary documents throughout the month, making your review preparation seamless.

2. Analyzing Sales Performance: Decoding Your Revenue Story

Sales analysis forms the heartbeat of your monthly business review, revealing not just how much money came through your doors, but the story behind those numbers. Raw sales figures tell you what happened, but proper analysis reveals why it happened and what you can do about it.

Start with the big picture by comparing this month’s total sales to the previous month and the same month last year if you have that data. Look beyond simple increases or decreases—examine the context. Was there a holiday, seasonal event, or economic factor that influenced results? Understanding the “why” behind changes helps you distinguish between trends and anomalies.

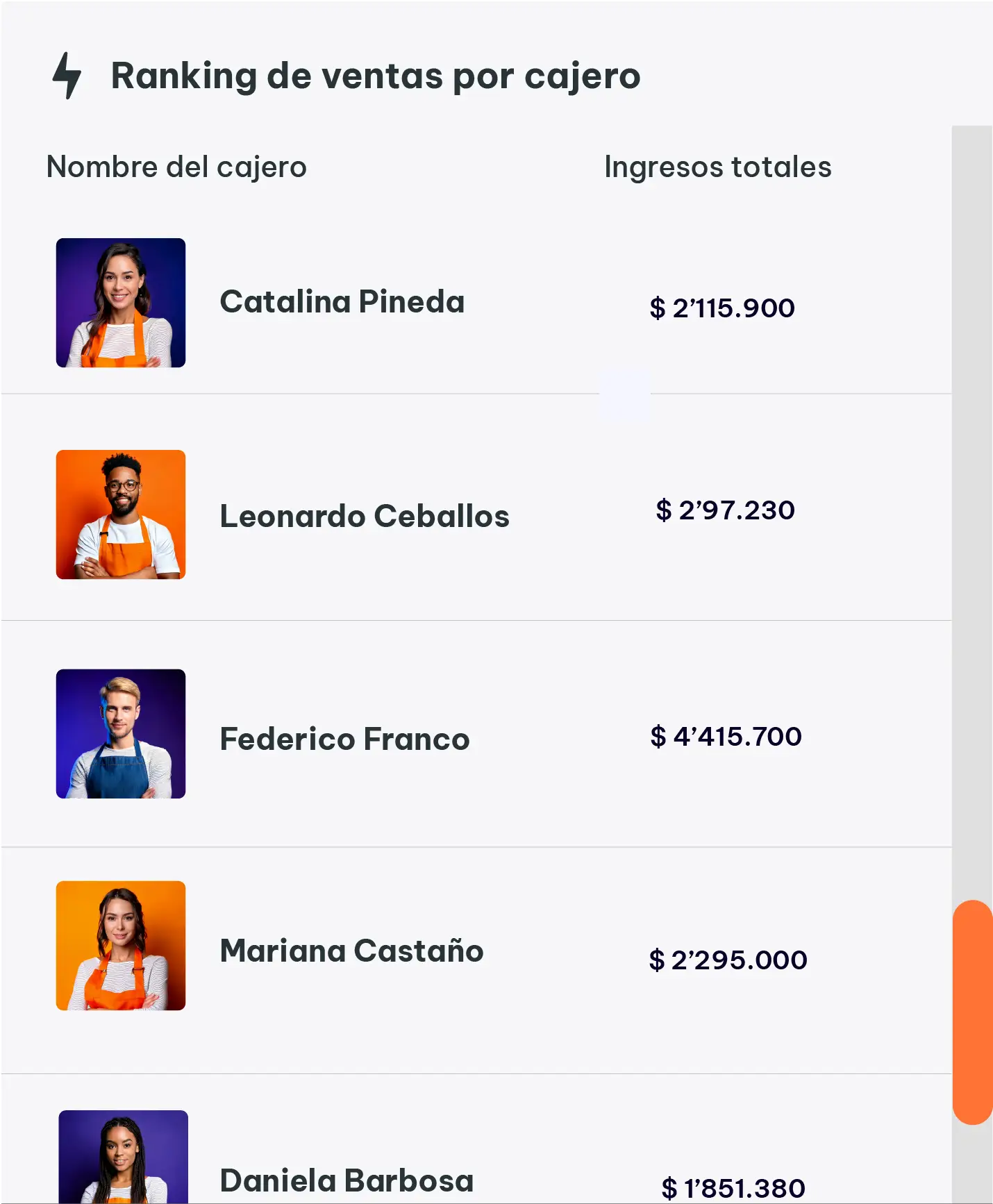

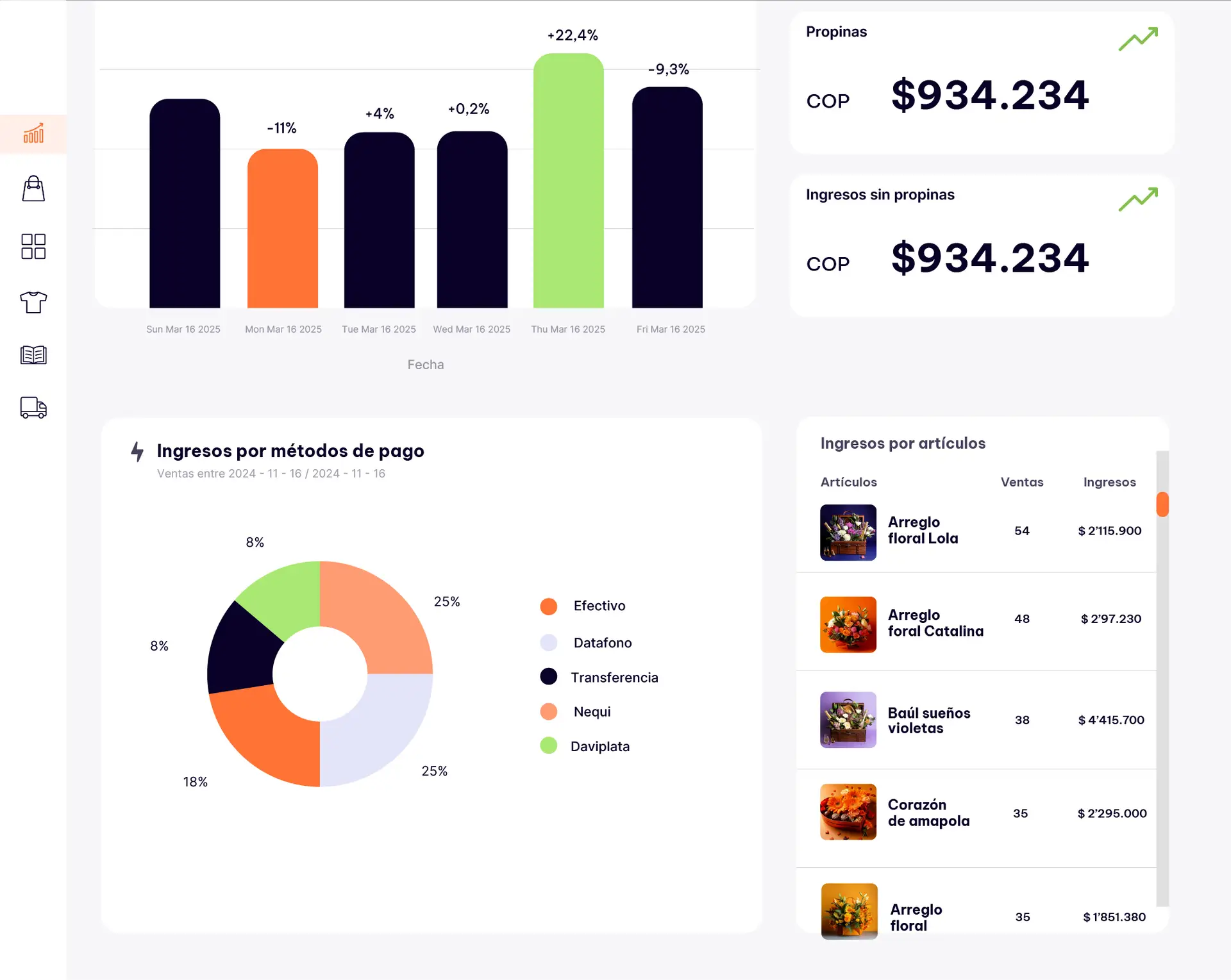

Break down your sales by product categories, individual products, and time periods. Which products or categories drove the majority of your revenue? Were there surprising performers or disappointing underachievers? Analyze daily and weekly patterns within the month. Many retailers discover that certain days consistently outperform others, or that specific weeks show predictable patterns tied to paydays, local events, or customer behaviors.

Customer transaction analysis provides crucial insights into buying behaviors. Calculate your average transaction value and compare it to previous periods. A declining average transaction value might indicate customers are buying less per visit, suggesting opportunities for upselling or bundle deals. Conversely, an increasing average might reflect successful merchandising or pricing strategies.

Examine your sales by customer segments if you track this information. New customers versus returning customers often show different purchasing patterns and respond to different marketing approaches. Understanding these differences helps you tailor your strategies more effectively. If you don’t currently segment customers, consider implementing a simple system to track this valuable data.

Don’t overlook the importance of analyzing refunds, returns, and exchanges. These metrics often reveal quality issues, sizing problems, or misaligned customer expectations. A sudden spike in returns for specific products might indicate a supplier issue or marketing message that doesn’t match the actual product experience.

Geographic analysis can be valuable if you serve customers from different areas. Are certain neighborhoods or regions contributing disproportionately to your sales? This information might influence your marketing spend, inventory decisions, or even expansion plans.

Consider seasonal adjustments in your analysis. Retail businesses often experience predictable seasonal fluctuations, and understanding these patterns helps you set realistic expectations and plan accordingly. Create a simple chart tracking your monthly sales over time to visualize these patterns clearly.

Practical Exercise: Create a sales analysis template that includes total sales, average transaction value, top 10 performing products, bottom 5 performing products, daily sales breakdown, and comparison to previous month and same month last year. Use this template to analyze your most recent month’s performance.

3. Inventory Management Review: Optimizing Your Product Mix

Inventory represents one of your largest investments and directly impacts your cash flow, storage costs, and customer satisfaction. A thorough monthly inventory review helps you optimize this critical aspect of your retail operation, ensuring you have the right products in the right quantities at the right time.

Begin your inventory analysis by calculating key metrics that reveal the health of your stock management. Inventory turnover rate shows how quickly you’re selling through your products—a low turnover rate might indicate overstocking or slow-moving items, while a very high rate could suggest missed sales opportunities due to stockouts. Calculate this by dividing your cost of goods sold by your average inventory value.

Identify your fastest and slowest-moving products. Fast-moving items deserve attention to ensure you never run out, as stockouts directly translate to lost sales and potentially lost customers. Slow-moving inventory ties up cash and storage space while potentially becoming obsolete. Create action plans for both categories: increase orders for fast movers and develop strategies to move slow inventory through promotions, bundling, or clearance sales.

Analyze your inventory by categories and suppliers. Are certain categories consistently outperforming others? Is one supplier providing products that sell faster than another’s? This analysis helps inform future purchasing decisions and supplier relationships. You might discover opportunities to expand successful categories or need to reconsider underperforming ones.

Examine your stock levels relative to sales velocity. Products that sell one unit per month don’t need the same inventory levels as those selling ten units daily. Develop simple formulas for reorder points based on sales velocity and lead times. This prevents both overstocking and stockouts while optimizing your cash flow.

Review your purchasing decisions from the previous month. Which products exceeded expectations, and which disappointed? Were there items you wish you’d ordered more of, or others you regret purchasing? Document these insights to improve future buying decisions. Many successful retailers keep a simple log of purchasing lessons learned.

Consider seasonal factors in your inventory analysis. Products that sell well in certain seasons should be ordered accordingly, and you should plan to clear seasonal inventory before seasons end. Create a calendar noting when to order seasonal items and when to begin clearance activities.

Don’t forget to analyze inventory shrinkage—the difference between what your records show and what’s actually on your shelves. Regular monitoring helps identify theft, administrative errors, or supplier issues early. While some shrinkage is normal in retail, sudden increases warrant investigation.

Evaluate your supplier relationships during inventory reviews. Are suppliers delivering on time? Is product quality consistent? Are their prices competitive? Strong supplier relationships are crucial for inventory success, and monthly reviews help you identify relationship issues before they become critical problems.

Practical Exercise: Calculate your inventory turnover rate for your top 20 products. Identify your top 5 fastest-moving and top 5 slowest-moving items. Create action plans for each category: reorder strategies for fast movers and clearance plans for slow movers.

4. Customer Insights and Behavior Analysis: Understanding Your Market

Understanding your customers goes far beyond knowing who bought what—it’s about recognizing patterns, preferences, and opportunities that can transform your business strategy. Monthly customer analysis helps you build stronger relationships, improve marketing effectiveness, and create experiences that turn occasional buyers into loyal advocates.

Start by analyzing your customer acquisition metrics. How many new customers did you gain this month, and through what channels did they discover your business? Compare acquisition costs across different marketing channels—word-of-mouth referrals might be free but limited in scale, while social media advertising costs money but reaches broader audiences. Understanding these dynamics helps you allocate marketing resources more effectively.

Examine customer retention patterns by tracking repeat purchase behavior. What percentage of customers made multiple purchases this month? How long is the typical gap between first and second purchases? Customers who return within a certain timeframe are more likely to become regular shoppers, so identifying this timeframe helps you create targeted follow-up strategies.

Analyze purchasing patterns across different customer segments. New customers often behave differently than established ones—they might start with smaller purchases to test your products and service quality. Long-term customers might be more willing to try new products or make larger purchases. Understanding these differences helps you tailor your approach to each segment.

Review customer feedback and complaints received during the month. Look for recurring themes that might indicate systemic issues or opportunities for improvement. A single complaint might be an isolated incident, but multiple customers mentioning the same concern suggests a problem worth addressing. Equally important, positive feedback reveals what you’re doing right and should continue or expand.

Examine seasonal customer behavior if you have historical data. Do certain customer segments shop more frequently during specific times of the year? Do purchasing patterns change with seasons, holidays, or local events? This information helps you prepare for predictable fluctuations and capitalize on seasonal opportunities.

Analyze customer communication preferences if you collect this information. Some customers prefer email updates while others respond better to text messages or social media engagement. Understanding these preferences helps you deliver the right message through the right channel, improving engagement rates and customer satisfaction.

Consider demographic patterns in your customer base. Are you attracting the customer segments you intended to serve? If your ideal customer is working professionals aged 25-40, but most of your actual customers are retirees, you might need to adjust your marketing message, product mix, or pricing strategy.

Don’t overlook the importance of analyzing customer service interactions. How many customers contacted you with questions or concerns? What were the most common issues? Long response times or unresolved problems can quickly damage customer relationships and harm your reputation through negative word-of-mouth.

Practical Exercise: Create a customer profile template that includes acquisition channel, purchase frequency, average order value, preferred communication method, and any feedback provided. Use this template to analyze your top 20 customers from the past month, looking for common patterns that might inform your customer strategy.

5. Financial Health Check: Ensuring Sustainable Profitability

Financial analysis during your monthly review goes beyond simply checking if you made money—it’s about understanding the sustainability and efficiency of your profit generation, identifying potential cash flow issues before they become critical, and making informed decisions about investments and expenses.

Begin with a comprehensive profit and loss analysis. Calculate your gross profit margin by subtracting the cost of goods sold from your total sales, then dividing by total sales. This percentage reveals how much money you have available to cover operating expenses and generate net profit. A declining gross margin might indicate rising supplier costs, increased shrinkage, or pricing pressure that needs attention.

Examine your operating expenses in detail, categorizing them into fixed costs (rent, insurance, base salaries) and variable costs (marketing, utilities, commission-based pay). Look for unexpected increases or opportunities for optimization. Sometimes small expenses can creep up over time without notice—subscription services you no longer use, marketing campaigns that aren’t performing, or supply costs that have gradually increased.

Analyze your cash flow patterns throughout the month. Retail businesses often experience uneven cash flow, with strong periods followed by slower ones. Understanding these patterns helps you plan for lean periods and avoid cash crunches. If you notice consistent cash flow challenges, consider strategies like payment terms with suppliers, inventory financing, or seasonal credit lines.

Review your key financial ratios and compare them to industry benchmarks when possible. Current ratio (current assets divided by current liabilities) indicates your ability to meet short-term obligations. Inventory-to-sales ratio shows how efficiently you’re managing stock levels. Debt-to-equity ratio reveals your financial leverage and risk levels.

Examine your pricing strategy effectiveness by analyzing margins across different products and categories. Some products might generate high volume but low margins, while others provide excellent margins but limited sales. Understanding this mix helps you optimize your product portfolio and promotional strategies.

Don’t overlook tax implications in your monthly financial review. Are you setting aside adequate funds for quarterly tax payments? Are you taking advantage of available deductions for business expenses? Staying on top of tax considerations monthly prevents year-end surprises and optimizes your tax situation.

Consider the return on investment for major expenses incurred during the month. That new display fixture or marketing campaign should generate measurable returns. While some investments take time to pay off, tracking ROI helps you make better decisions about future expenditures.

Analyze your break-even point and understand how many sales you need to cover all expenses. This knowledge is crucial for setting sales targets, evaluating performance, and making decisions about operating hours, staffing levels, or promotional activities.

Practical Exercise: Create a simple financial dashboard showing gross profit margin, operating expense ratio, cash flow summary, and break-even sales target. Calculate these metrics for your most recent month and compare them to your previous month to identify trends that need attention.

Final Reflection: Transforming Insights into Action

You now hold the blueprint for conducting monthly business reviews that can transform your retail operation from reactive to strategic, from hopeful to informed, and from surviving to thriving. But knowledge without action remains merely potential energy waiting to be unleashed.

The monthly business review isn’t just about looking backward at what happened—it’s about looking forward with clarity and confidence. Each review builds upon the previous one, creating a compound effect of understanding that becomes your competitive advantage. While your competitors might be guessing about customer preferences, seasonal patterns, or inventory needs, you’ll be making decisions based on concrete data and proven insights.

Remember that perfection isn’t the goal; progress is. Your first few monthly reviews might feel overwhelming or incomplete, and that’s perfectly normal. Like any skill, this process improves with practice. What matters most is starting and maintaining consistency. The retailer who conducts imperfect monthly reviews for six months will have far more insight than the one who waits for the perfect system before beginning.

The magic happens when you begin connecting dots across months. You’ll start noticing patterns that weren’t visible in daily operations—customer behaviors that predict seasonal trends, inventory decisions that consistently pay off, marketing efforts that generate lasting results. These insights become the foundation for strategic decisions that drive sustainable growth.

Don’t let analysis paralysis prevent you from taking action on your insights. The goal isn’t to analyze everything perfectly but to identify the most impactful opportunities and address the most pressing challenges. Sometimes a simple insight—like discovering that Thursday afternoons are consistently slow—can lead to meaningful improvements through targeted promotions or adjusted staffing.

Your monthly review should energize, not exhaust you. If you find yourself dreading this process, simplify it. Focus on the metrics that matter most to your specific situation. A busy single-store owner needs different insights than a multi-location retailer. Customize your approach to match your reality and goals.

Most importantly, use your monthly reviews to celebrate progress alongside identifying improvements. Acknowledge the wins, no matter how small. That customer who left a glowing review, the product that exceeded expectations, the successful promotion that brought in new customers—these victories deserve recognition and can inform future strategies.

The retail landscape continues evolving rapidly, but the fundamental principle remains constant: businesses that understand themselves deeply outperform those that don’t. Your monthly business review is your commitment to that understanding, your investment in long-term success, and your pathway to building a retail operation that doesn’t just survive market changes but thrives because of them.

Start your first monthly review within the next week. Don’t wait for the perfect system or complete data. Begin with what you have, learn from the process, and refine your approach over time. Your future self—and your business—will thank you for taking this crucial step toward informed, strategic retail management.